Corporate Governance

Fundamental Approach

Our fundamental approach to corporate governance is based on the recognition that the foundation of our corporate activities consists of management that resonates with and earns the trust of our stakeholders, including our shareholders, customers, business partners, employees, and local communities. We aim to achieve sustained growth and to increase our corporate value over the medium and long term. We have defined key measures for achieving the following: we will strive to reinforce our management base on a sustained basis, to ensure the soundness and transparency of our management, to continuously enhance our corporate governance, and to prepare and reinforce our internal control structure.

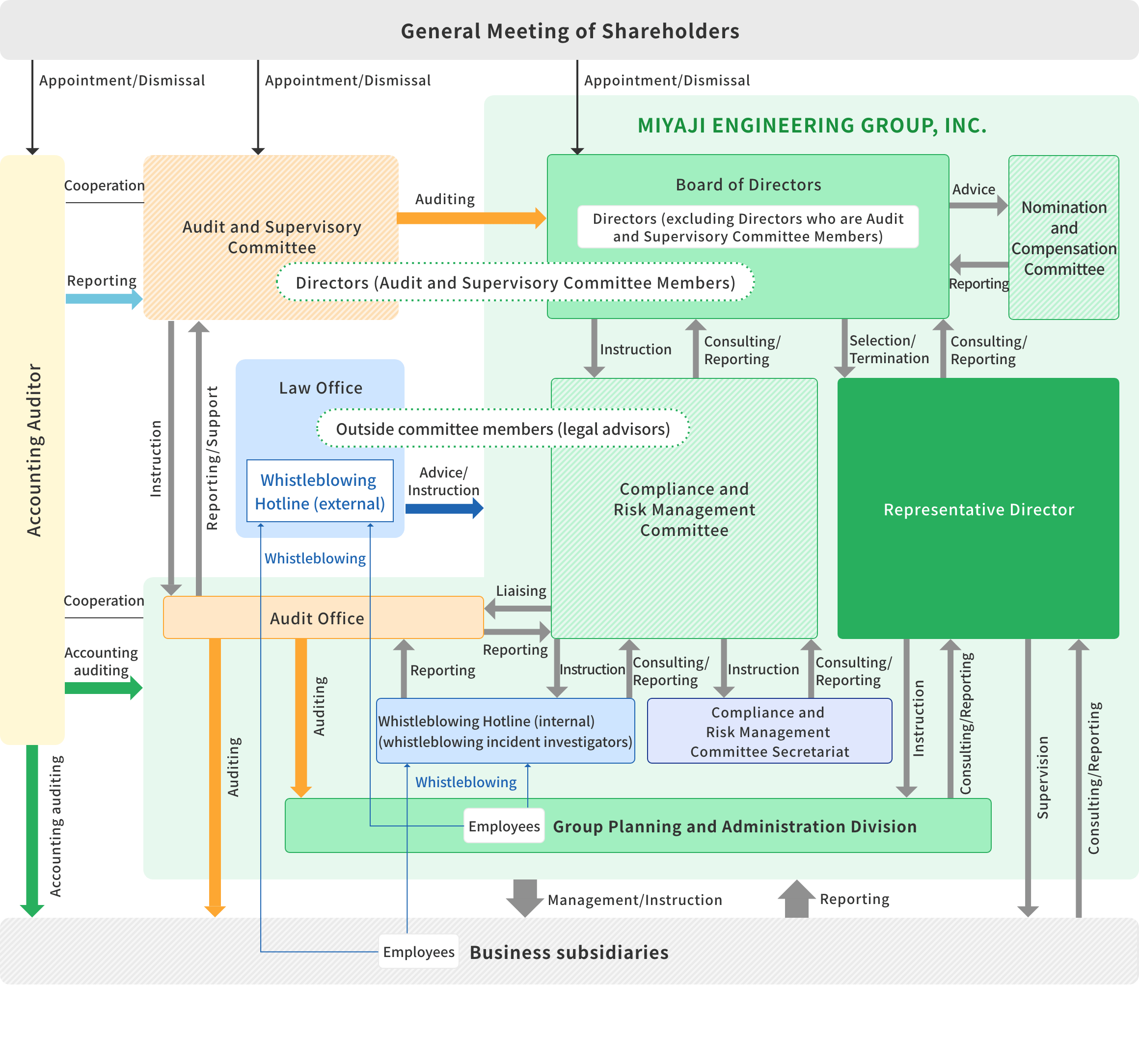

Corporate Governance Structure

We have adopted the format of a Company with an Audit and Supervisory Committee from the perspective of further enriching our corporate governance system. We selected this format because assigning the voting rights of the Board of Directors to Directors who are Audit and Supervisory Committee Members will further enhance the auditing and supervision functions of the Board of Directors, will accelerate decision-making, and will enrich discussions from a medium- and long-term perspective. In conjunction with this, we have established a Nomination and Compensation Committee and a Compliance and Risk Management Committee. Our goal in creating the voluntary Nomination and Compensation Committee, over half of whose members are Independent Outside Directors, is to reinforce the independence, objectivity, and accountability of the Board of Directors’ functions with respect to the nomination and compensation of Directors. Our goals in creating the Compliance and Risk Management Committee, which is composed of outside committee members such as a lawyer, is to build and tune our system for managing compliance and risks within the Group, to operate the system appropriately, and to fully establish the operation of the system within the Group. The Board of Directors makes decisions after receiving inquiries and advice from the respective committees, thereby engaging in business management with a high level of legal compliance and transparency. At the same time, we believe that the committees provide management monitoring functions that contribute significantly to the establishment of corporate governance.

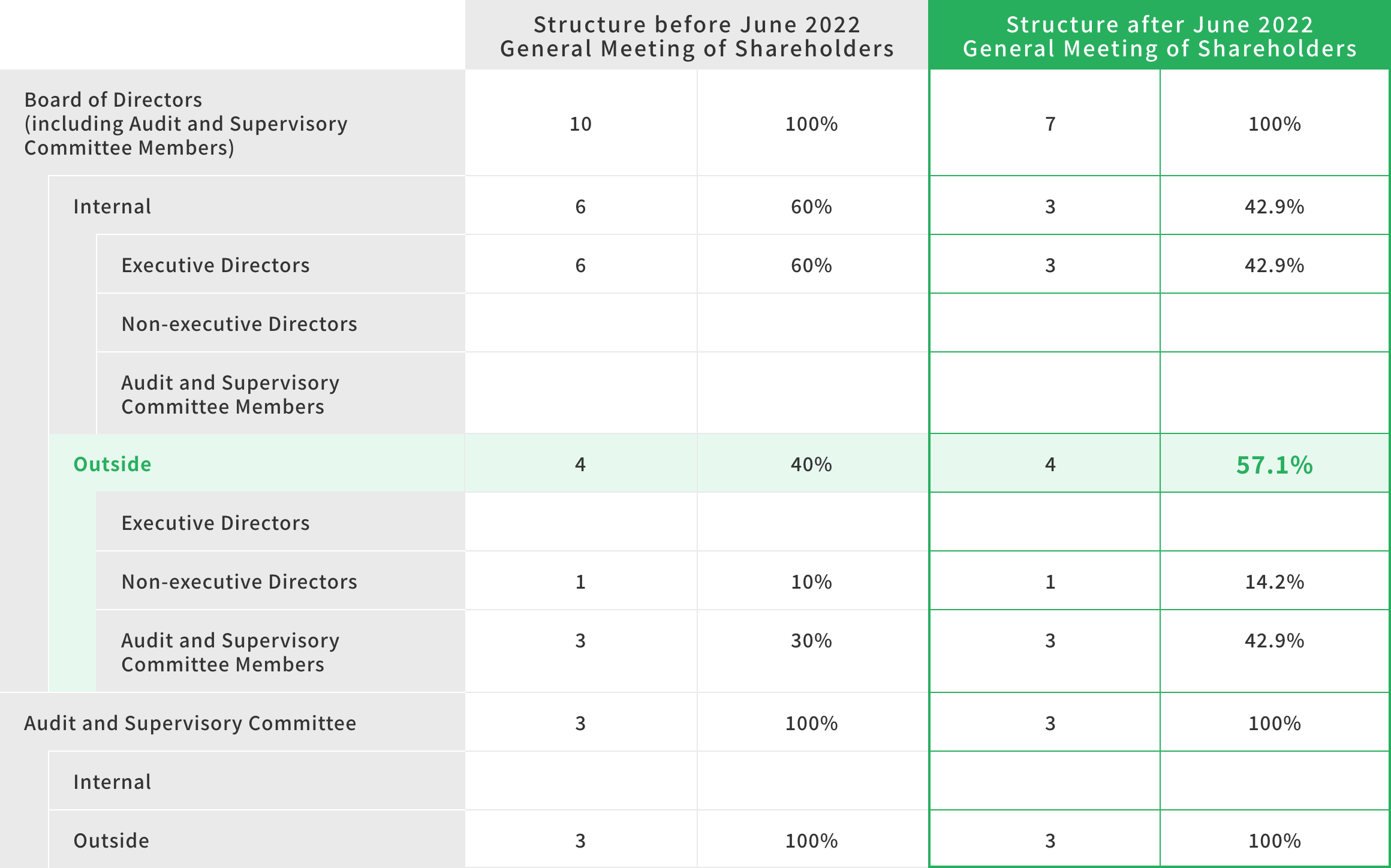

Reinforcing Our Governance Structure

At our 19th General Meeting of Shareholders, held in June 2022, we reduced the number of Directors from ten (including four Independent Outside Directors) to seven (including four Independent Outside Directors). This raised the percentage of Independent Outside Directors to over 50% of the Board of Directors with the aim of further enriching our governance structure.

Policy on Constructive Dialogue with Shareholders

1.IR Policy

We take the opinions of our shareholders very seriously, and in order to reflect them in the operation of our company, we disclose accurate information regarding our management in a timely manner and we engage in constructive dialogue with our shareholders. Through this, we strive to produce sustained growth and increase our corporate value over the medium and long term.

2.IR Structure and Methods of Engaging in Dialogue

We strive to actively engage in dialogue with our shareholders, primarily through the Director in charge of IR and our IR Office. Furthermore, we hold financial results briefings for analysts and institutional investors (twice per year), and we post the materials used in these briefings, along with videos of the briefings, on our website. We strive to immediately post information such as our company profile, management policy, group structure, compliance information (Charter of Corporate Behavior), IR information (convocation notices, reports, interim reports, earnings briefings, securities reports, and other disclosure materials), and the like on our website.

3.Insider Information

We manage insider information thoroughly with respect to our dialogue with shareholders.

Internal System for Timely Disclosure of Corporate Information

We have adopted a basic policy of timely and appropriate disclosure of corporate information to investors. This disclosure is performed through the following internal system.

1.Information Regarding Decisions Made

Information regarding matters decided in regular Board of Directors meetings, extraordinary Board of Directors meetings held when necessary, and other important meetings is disclosed in a timely manner in accordance with the Tokyo Stock Exchange, Inc’s Timely Disclosure Rules and other laws and regulations.

2.Information Regarding Events

Information regarding events is reported by the responsible department to the Board of Directors, etc. With regard to this information, the IR Office, the General Affairs and Personnel Department, and the Planning and Management Department, led by the person responsible for dealing with information, deliberate regarding the need for timely disclosure, while seeking the advice and instruction from an accounting auditor, legal advisers, and other experts as needed. Information regarding events within the scope of timely disclosure standards is, as a general rule, disclosed in a timely manner, without delay, after being decided on by the Board of Directors.

3.Information Regarding the Settlement of Accounts

Information regarding financial settlements is disclosed in a timely manner after receiving advice and instruction and being audited by the accounting auditor as needed, and being decided on by the Board of Directors.

4.Information Regarding Operating Subsidiaries

The Company supervises and manages our Group as its holding company.

Decisions made by operating subsidiaries in important meetings such as Board of Directors meetings and events arising due to outside circumstances are reported by the information management division to the IR Office, the General Affairs and Personnel Department, or the Planning and Management Department. In accordance with internal regulations, decisions are made by the Company’s Board of Directors, etc., or reported.

With regard to information regarding operating subsidiaries reported by operating subsidiaries, the IR Office, the General Affairs and Personnel Department, and the Planning and Management Department, led by the person responsible for dealing with information, deliberate regarding the need for timely disclosure, while seeking the advice and instruction from the accounting auditor, legal advisers, and other experts as needed.

Information regarding operating subsidiaries within the scope of timely disclosure standards is, as a general rule, disclosed in a timely manner, without delay, after being decided on by the Board of Directors.

5.Other Important Information

With regard to other important information, the IR Office, the General Affairs and Personnel Department, and the Planning and Management Department, led by the person responsible for information management, deliberate regarding the need for timely disclosure, while seeking the advice and instruction from the accounting auditor, legal advisers, and other experts as needed. Other important information within the scope of timely disclosure standards is, as a general rule, disclosed in a timely manner, without delay, after being decided on by the Board of Directors.