Under our previous Medium-Term Business Plan, we made steady progress in our efforts to implement business strategies and reinforce our business foundation, solidifying the foundation in preparation for our next Medium-Term Management Plan.

We expect our business environment during the period of the current Medium-Term Business Plan to be a strong one. Regarding expressways, the percentage of highway bridges that were constructed over 50 years ago is rising rapidly, which will drive the growth of large-scale renovation and large-scale repair business. Furthermore, details are taking shape regarding a large-scale project aimed at addressing the issue of missing links between expressways.

Medium-Term Business Plan

Vision for 2026

We will maintain our position as one of the industry's finest comprehensive engineering companies, excelling at fabrication and engineering, including partner companies led by some of Japan's leading scaffolding teams with advanced skills and capabilities backed by extensive experience. We will further strengthen coordination within our Group, improve both the quality and quantity of management resources, enhance our competitiveness, and participate in large-scale construction projects that contribute to the enrichment of society. Through these efforts, we will increase both our revenue and our profits, increasing our corporate value through sustained growth.

Vision and Business Strategies

Key strategies

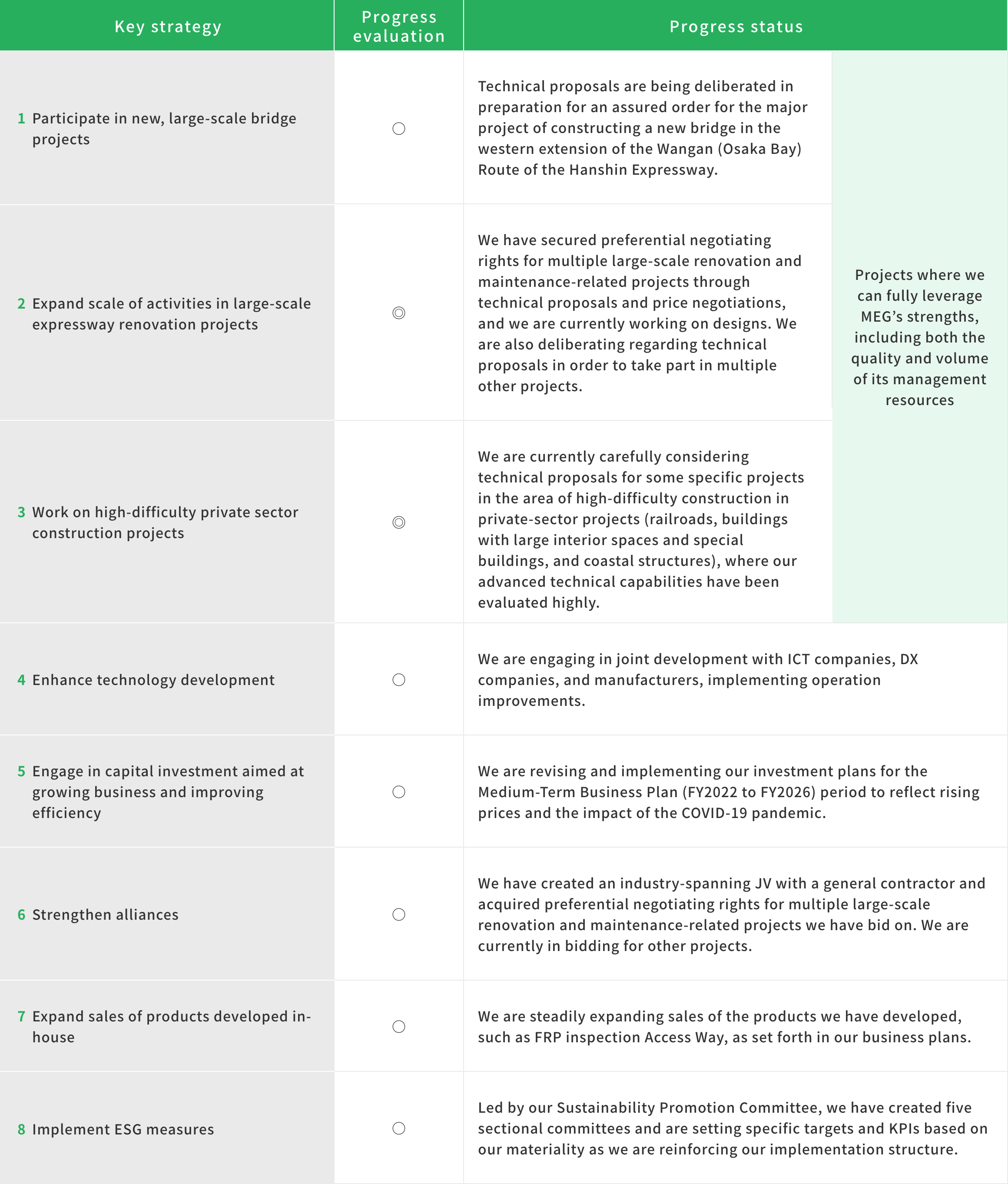

We will implement eight business strategies as we work toward the vision for 2026.

- 01Participate in new, large-scale bridge projects

- 02Expand scale of activities in large-scale expressway renovation projects

- 03Work on high-difficulty private sector construction projects

- 04Enhance technology development

- 05Engage in capital investment aimed at growing business and improving efficiency

- 06Strengthen alliances

- 07Expand sales of products developed in-house

- 08Implement ESG measures

Participate in new, large-scale bridge projects

With regard to the future demand environment, there are plans for large-scale new bridge construction projects such as the western extension of the Wangan (Osaka Bay) Route of the Hanshin Expressway (cable-stayed bridge). We will enhance the quality and quantity of our management resources to participate in these projects.

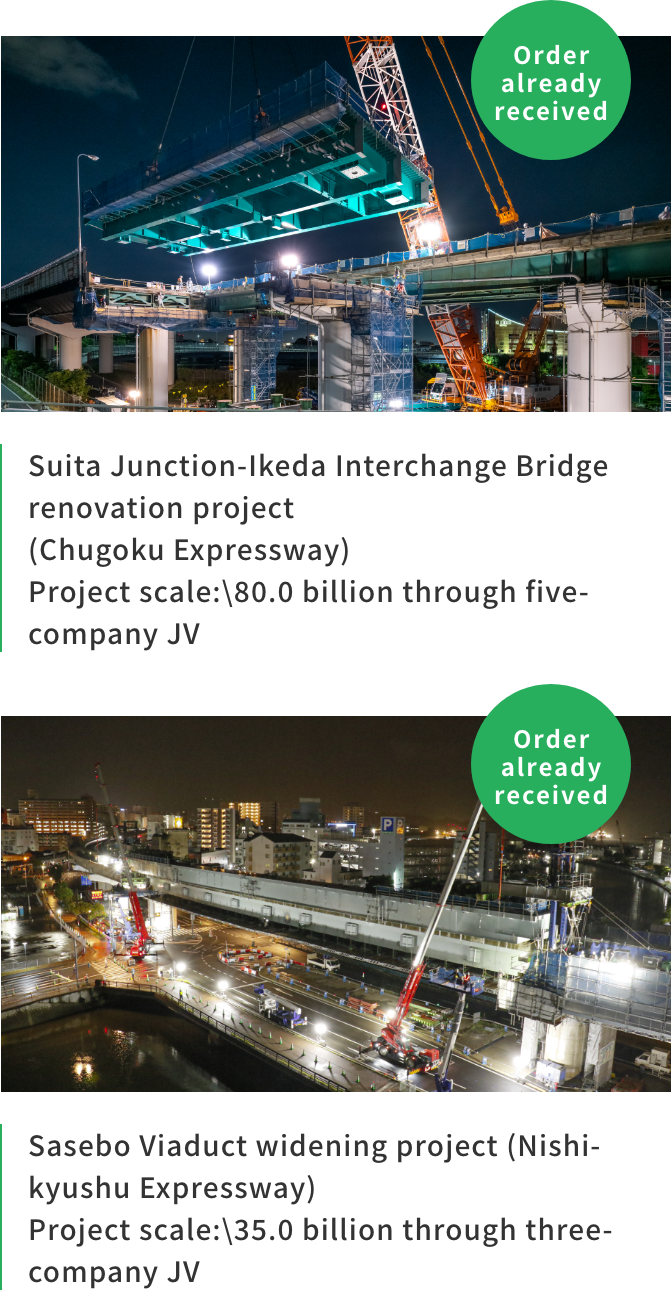

Expand scale of activities in large-scale expressway renovation projects

In large-scale expressway renovation projects, both the quality and quantity of management resources are required, and few companies, including MEG, are establishing a greater presence in this area.

There will be ongoing orders for large-scale renovation and large-scale repair projects, so we will aim to improve the likelihood of being selected for these projects and we will establish our business portfolio.

Investment in Productivity Improvement and Workstyle Reforms, etc.

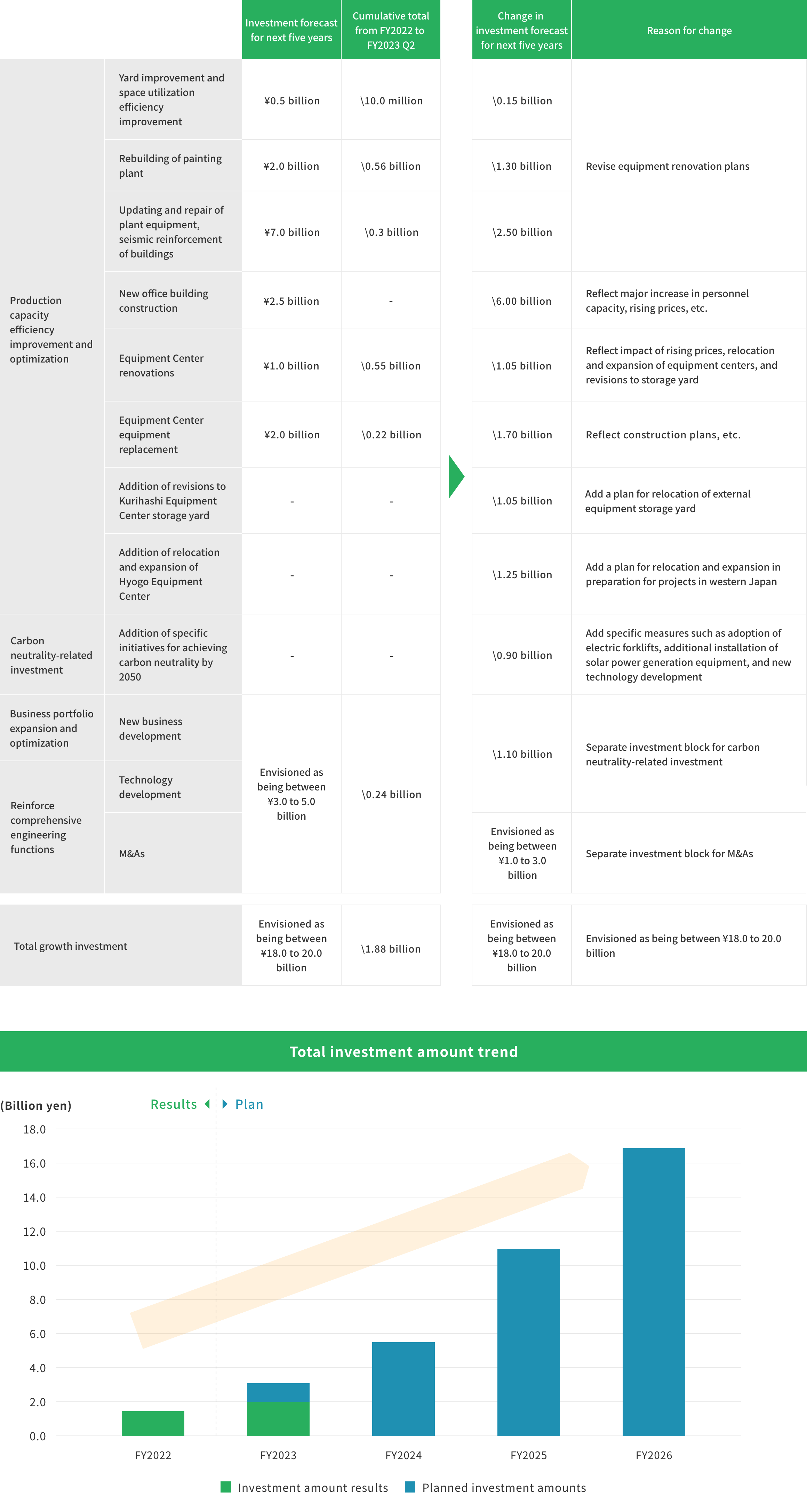

We forecast \12.0 billion in investment in the Chiba Works over the next five years.

In addition to enhancing production facilities in order to prepare for taking on large-scale projects, we will also make fixed cost, quality, and working environment improvements. For the Equipment Center, we will invest \3.0 billion in the updating and repair of facilities, with the aim of maintaining and improving the technologies we use in technically difficult construction projects, where we are establishing a greater presence.

We plan to invest \2.0 billion in DX, development, and environmental investment. Through this, we will improve our operation efficiency, expand our business, and make greater contributions to the environmental conservation.

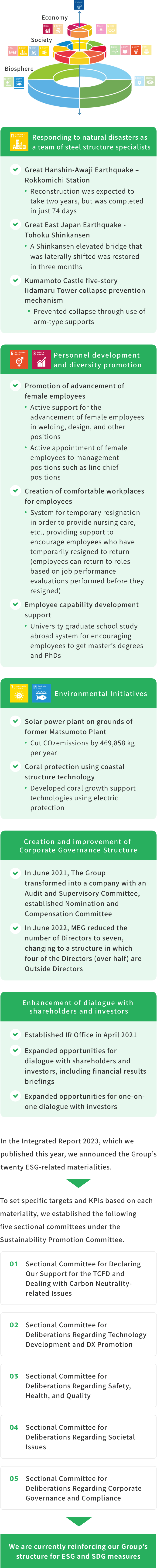

ESG and SDG Measures

We create measures for quickly and safety responding to natural disasters, formulate climate change policies, engage in personnel development, promote diversity promotion, and make improvements to our governance, recognizing all of these as being essential for ongoing corporate growth.We have also established an IR Office through which we are enhancing our functions for engaging in dialogue with investors.

Enhancement of dialogue with shareholders and investors

Capital Strategy

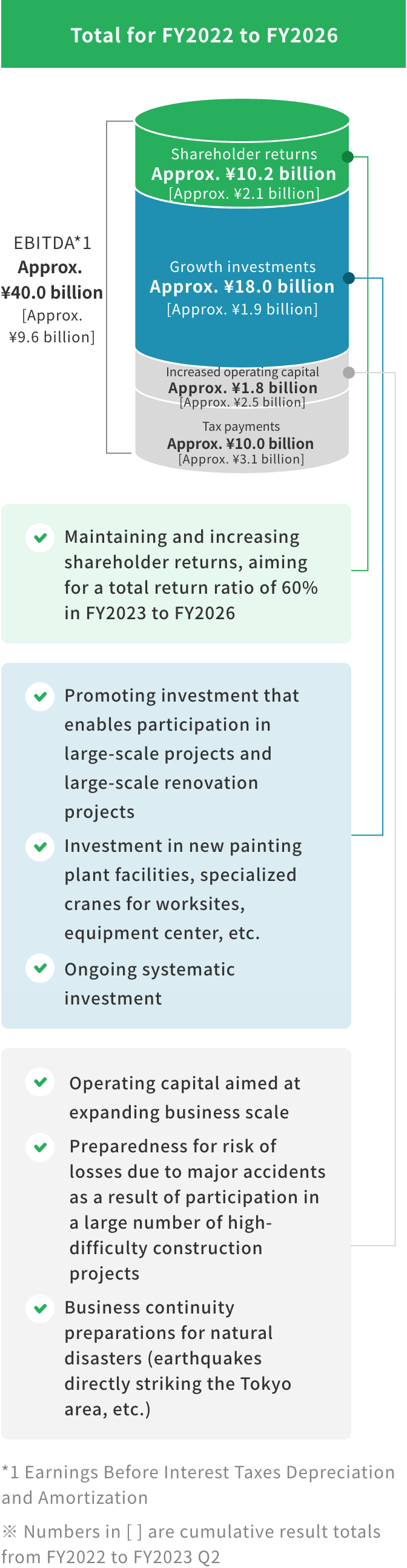

We will increase our capital to some degree and invest in growth, as we strive to maintain and increase our shareholder returns. Specifically, we forecast an EBITDA (earnings) of approximately \40.0 billion during the Medium-Term Business Plan period, and we plan to invest approximately \18.0 to 20.0 billion in growth. We will also increase our working capital by \6.0 billion to assist us in expanding the scale of our business, preparing for the risk of losses associated with our participation in high-difficulty construction projects, and ensuring business continuity in the event of a natural disaster such as an earthquake directly striking the Tokyo area.

We plan to maintain and increase shareholder returns, aiming for a total return ratio of 30%.

Investment Strategy

In addition to investing in productivity improvements, we also expect to invest \3.0 to 5.0 billion in new business development and the reinforcement of our comprehensive engineering functions. The total investment amount is expected to be \18.0 to 20.0 billion.

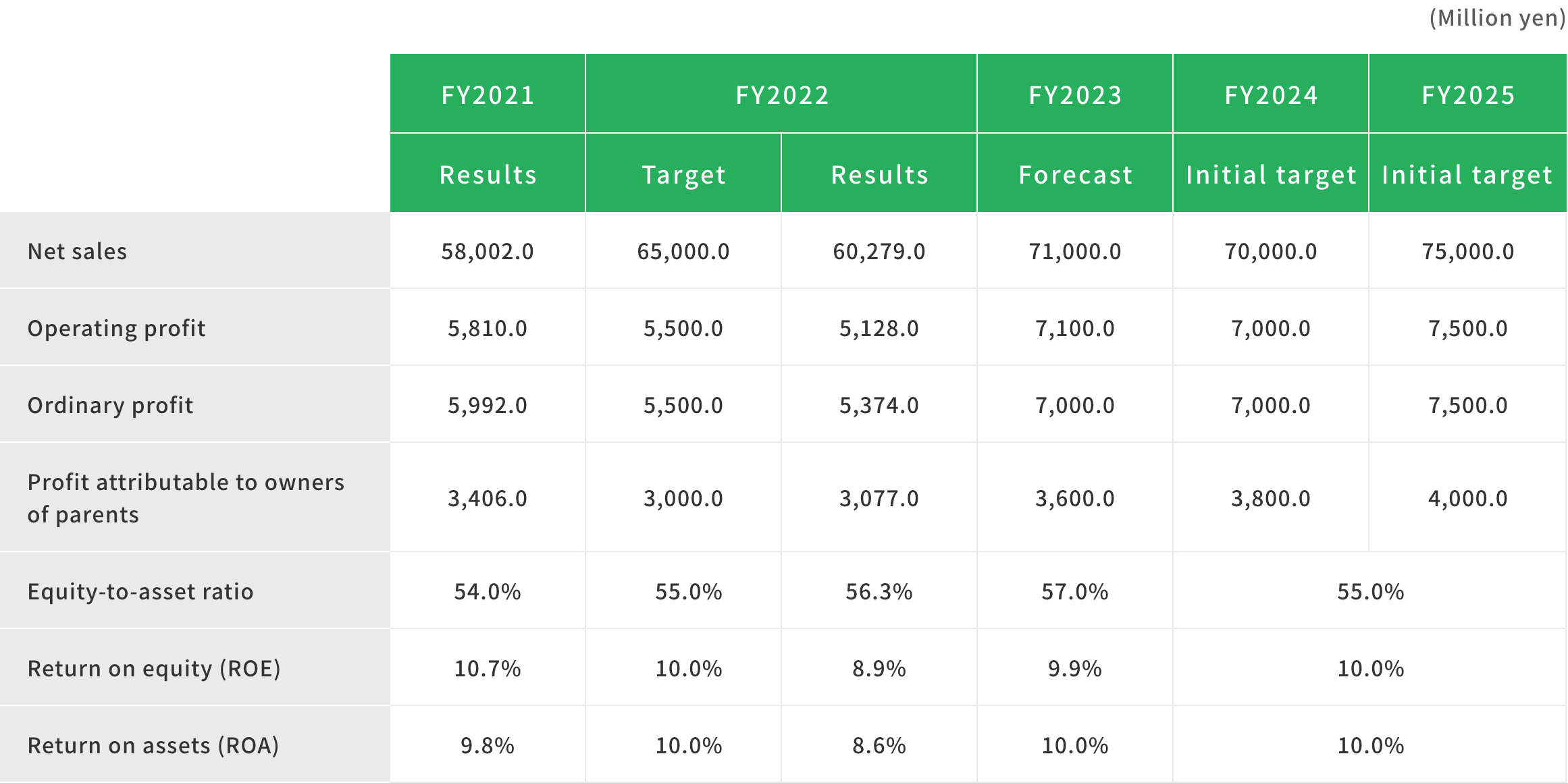

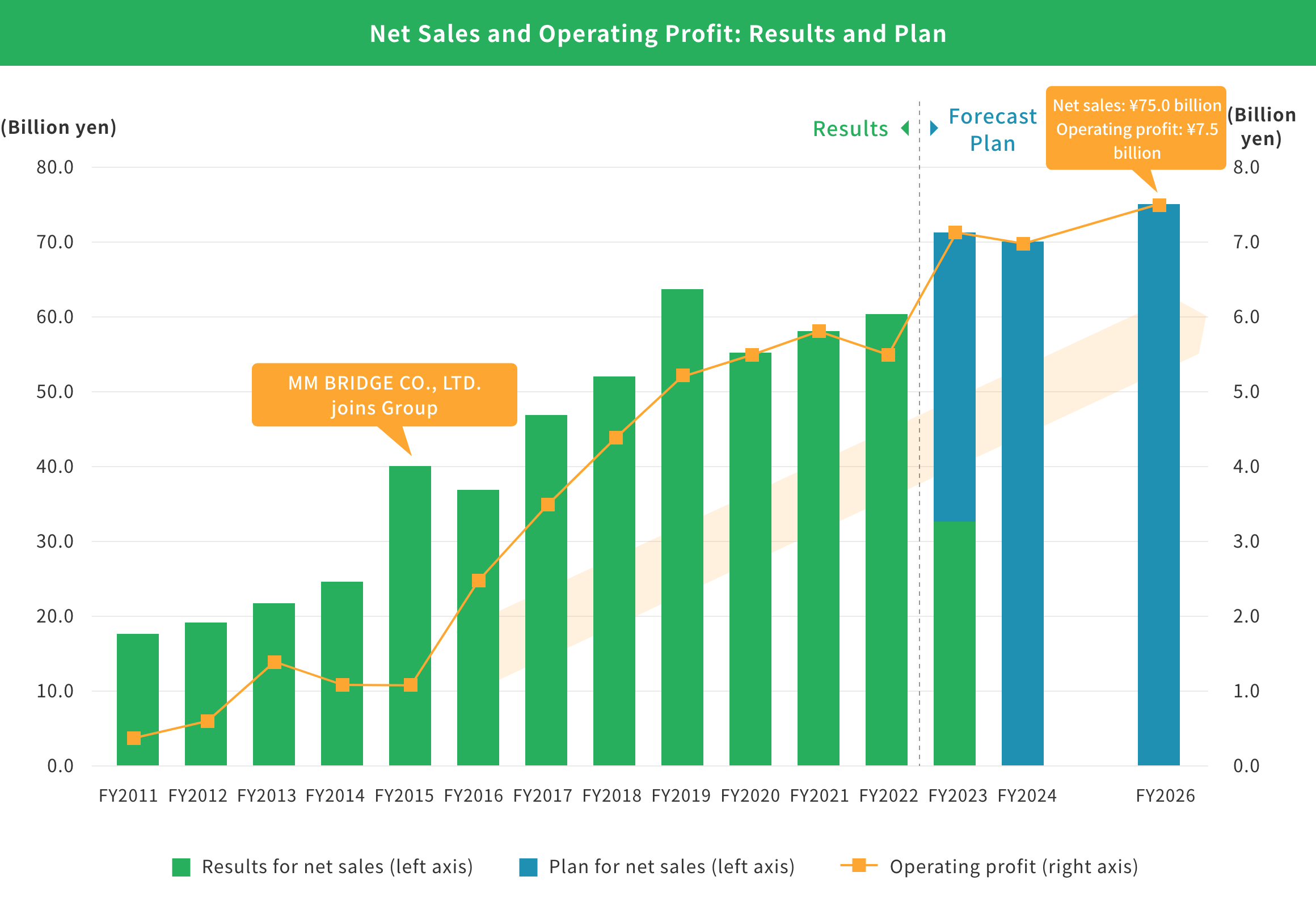

Quantitative Targets

Our targets for FY2026, the final year of the Medium-Term Business Plan, are as follows:

- Net sales: \75.0 billion (29.3% increase compared with FY2021)

- Operating profit: \7.5 billion (29.1% increase compared with FY2021)

- Ordinary profit: \7.5 billion (25.2% increase compared with FY2021)

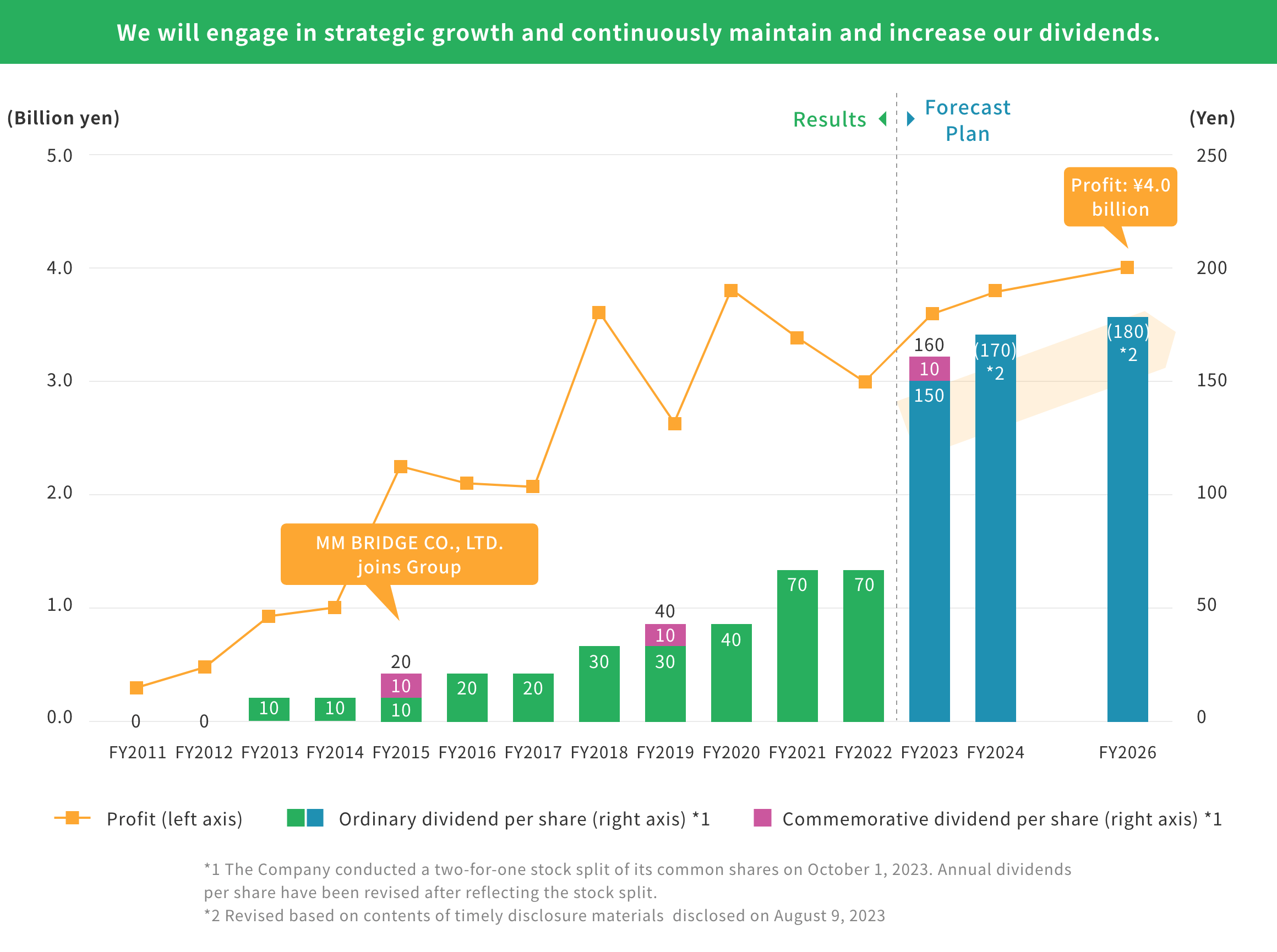

- Profit attributable to owners of parent: \4.0 billion (17.4% increase compared with FY2021)

We also aim to achieve an equity ratio of 55% or higher and an ROE and ROA of 10% or higher.

Dividend Policy

Our Group has set as one of our targets a dividend payout ratio of 60%, and we aim to continually maintain or increase the dividend per share of \140. We will strive to realize our Medium-Term Business Plan and further grow our dividends.

Related information

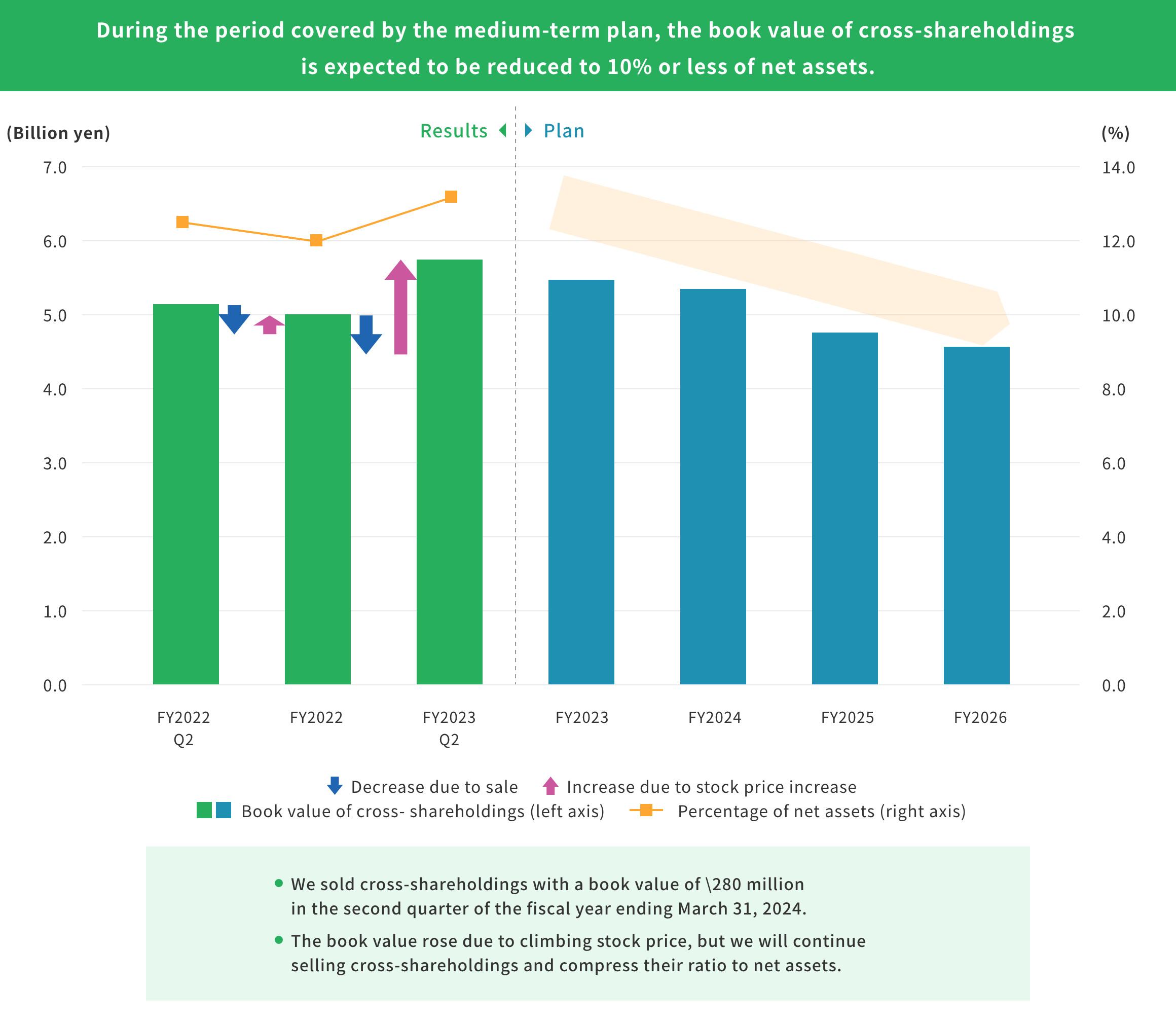

Strategic Holding Reduction Policy

Our strategic holdings are currently almost 13% of our net assets. However, we will actively sell shares during the plan period, lowering this percentage to 10% or less.